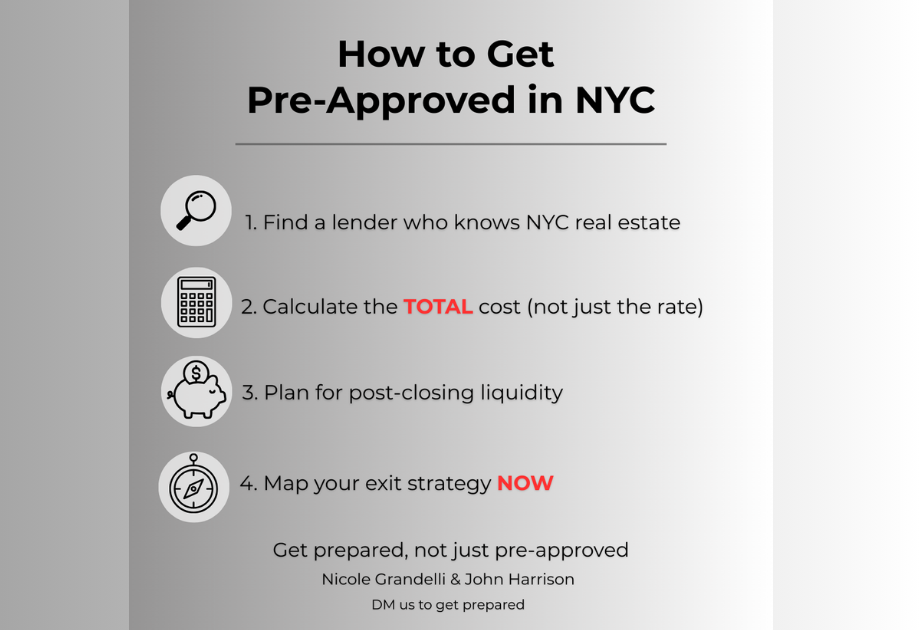

How to Get Pre-Approved for a Mortgage in NYC

Here’s What AI Won’t Tell You.

People search for this constantly.

AI gives the basics: what a pre-approval is, why you need one, and how to get one.

What doesn’t it tell you?

Most buyers are doing this completely wrong.

We’ve closed hundreds of luxury deals in Manhattan. And here’s what we know: the buyers who succeed aren’t the ones with the lowest rate, they’re the ones who prepare differently from day one.

Stop shopping, just the rate.

Here’s what actually matters.

1. Work with a lender who truly understands NYC real estate.

Not all lenders operate the same way in this market.

Some specialize in new developments and can lend earlier.

Some move faster.

Some work seamlessly with certain attorneys.

Some understand the nuances of luxury buildings and co-op board packages.

Those differences matter.

This is what we have our clients ask their banker:

“Do you offer preferred rates or fee reductions if I have an existing banking relationship? What if I move assets or accounts?”

Often, the best deal isn’t the lowest advertised rate; it’s the relationship pricing you know how to negotiate.

2. Look at the total cost, not just the rate.

A slightly higher interest rate with lower fees can actually cost less overall — but most buyers never break it down.

We have our clients ask their lender for the full picture: fees, insurance, recording taxes, all of it.

Then we make sure they ask the question most people never think to ask:

“Which of these are negotiable?”

That’s where real savings often appear.

3. Understand post-closing liquidity, theirs and yours.

☑️ Banks require cash reserves after closing.

☑️But the bank’s minimum isn’t always what you should feel comfortable with.

☑️We make sure our clients ask:

“What’s your post-closing liquidity requirement? And realistically, how much should I have set aside?”

Because being house-rich and cash-poor isn’t wealth, it’s stress.

4. Think about your exit strategy before you buy.

You may want to refinance in the future.

We have our clients ask early:

“What are the prepayment penalties? What does refinancing actually cost?

What could prevent me from refinancing later?”

Planning your exit strategy before you buy is how you stay in control.

This is our process with every buyer.

Before they look at a single apartment, we make sure they have the right lender, understand the full cost breakdown, know their liquidity needs, and have an exit strategy mapped out.

We just closed a deal in December where the buyers spent months in this preparation phase with us.

When we found the right place, they were ready; no surprises, no scrambling, no deal falling apart.

That’s the difference between getting pre-approved and being prepared by our team.

If you want someone who actually prepares you for this process, send us a message. This is how we work with every buyer.